- Search term must have more than 2 characters.

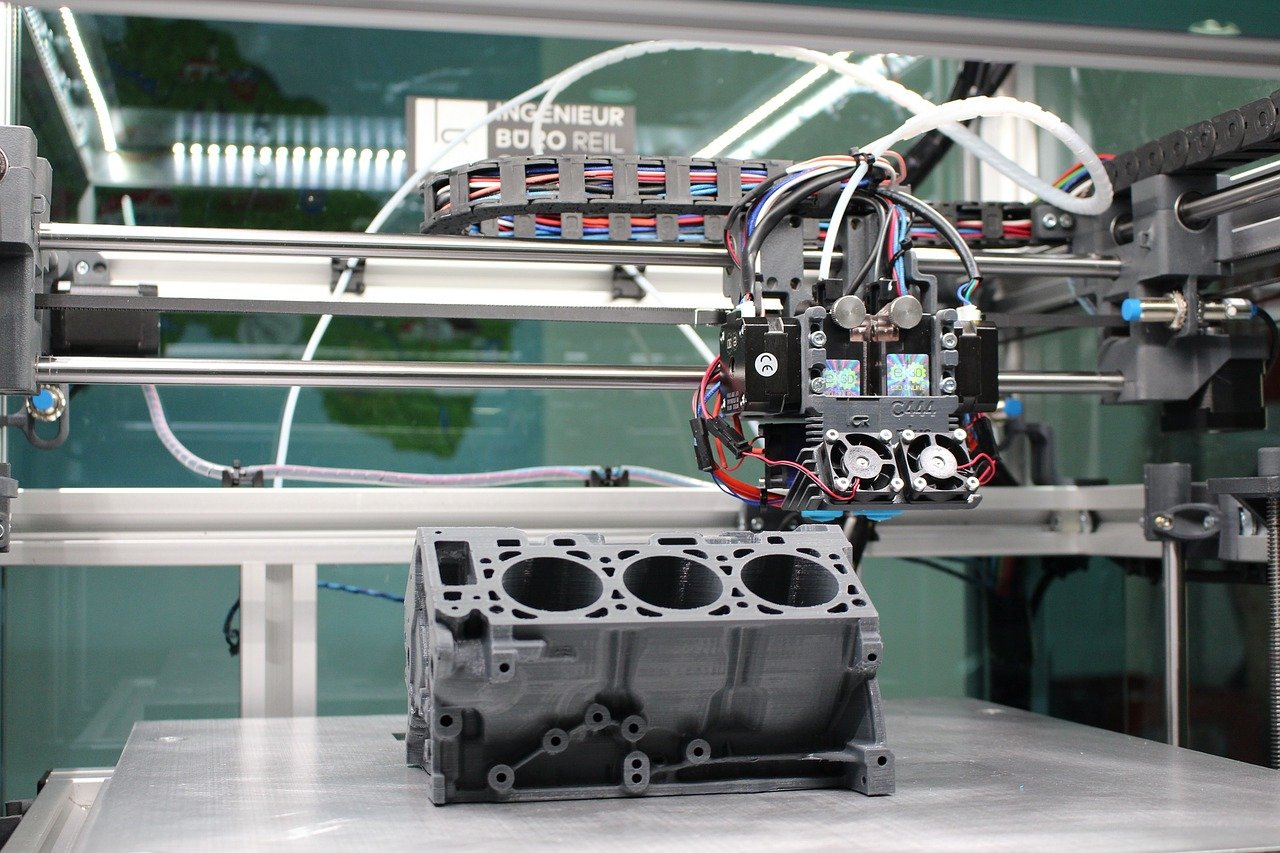

The mapping helped us to discover out about SMEs' readiness and motivation for transformation towards Industry 4.0. We mapped approximately 50 companies in each region involved (IT, DE, AUS, CZE, SLO, PL, HU). In total, we obtained very interesting data from 350 small and medium-sized enterprises in the Central European region. The survey involved companies specializing in manufacturing or supplying technology to Industry 4.0. The companies in the survey operate in a wide variety of sectors, but the largest share was made up of companies in the following sectors: Metal (except machinery), Machinery and equipment, and Computer programming, consultancy and related activities.

According to the survey, in the field of digitization are best companies from Germany and Austria. Even though more than half of the companies surveyed in these countries had fewer than 50 (10-49) employees. The survey shows that companies with between 50 and 250 employees and their development departments are in the best position to digitize.

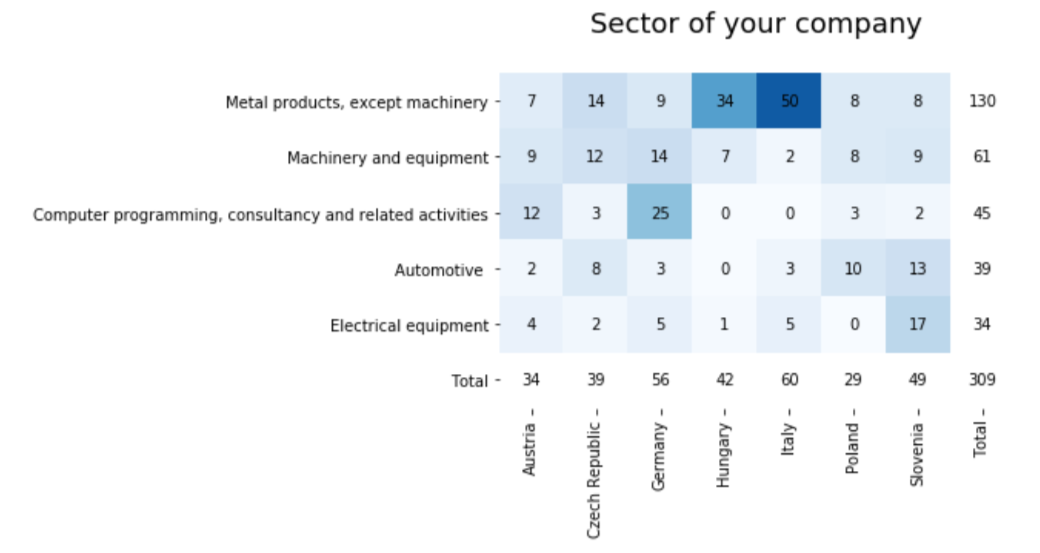

For companies from the Czech Republic, the topic Industry 4.0 is quite known. The areas of Industry 4.0 that we reflected in the mapping are known to the participants in our survey, but at the same time, they are not very widespread. There are many companies around us that do not deal with these topics at all or use them only to a very limited extent. In any case, there are very interesting companies in the Liberec Region that work with new technologies and use them in their production.

We can say that companies from the Czech Republic are most interested in their cybersecurity. Many companies are automotive suppliers where they have relatively strict rules and topics such as data protection and innovation is extremely important to them. This is reflected in the fact that they also emphasize cybersecurity for their suppliers. The figure shows what areas of industry 4.0 have their representation in addressed companies from the Czech Republic.

Business motivation varies. Managers decide about digital transform their companies based on interest in new customers and expansion to other markets. Another factor is also production optimization and cost savings.

What is interesting about the results is how companies finance their innovation and innovation processes. It turned out to be largely own resources. Overall, companies are not very successful in drawing subsidies. If so, there are some interesting differences. For example, one shows that larger companies have experience in drawing on international calls and that smaller companies (up to 50 employees) focus more on regional and national calls.

The survey helped us to find out other interesting information that will help us in the implementation of subsequent activities. However, the most important finding is which companies have the potential for digital transformation, which it is appropriate to engage in other activities or not to engage them and last but not least which support activities we can prepare for companies from our region.